VEHICLE LOANS & PRODUCTS THAT FIT YOUR NEEDS

Whether you’re buying or refinancing, we can help. We believe that shopping for a car and obtaining a vehicle loan should not be complicated, that is why we made it easy. We offer many types of vehicle loans from new and used car loans to motorcycle, boat, and RV loans. Whatever your borrowing needs may be, we can help with some of the most competitive rates and terms you'll find anywhere. Our service is fast, convenient, and confidential.

Get pre-approved today and be ready to buy the car you want. Ask a Credit Union Representative for more information or complete an online application today.

Auto Loans

BHSFFCU can get you behind the wheel of your new or used vehicle today. Great rates, flexible terms, and automatic payments can get you rolling now. If you have your vehicle financed somewhere else, we may be able to reduce your payments and save you money.

Looking for a lease alternative option, check out our FlexDrive Loan Program

Motorcycle Loans

Do you prefer two wheels and an open road? Whether you purchase a cruiser or your daily commuter, BHSFFCU has you covered with an affordable Motorcycle Loan.

Boat Loans

Thinking about buying a boat or personal watercraft? BHSFFCU can get you on the water today with a Boat Loan.

RV Loans

Ready to see the great outdoors and explore new areas with the family? We can help you hit the road with a Recreational Vehicle Loan. Whether you are buying a motor-home or camper, BHSFFCU has the loan for you!

PROTECT YOUR INVESTMENT

We've Got YOU Covered!

We offer some of the most competitive loan products available in the market. These loan products offer the peace of mind and confidence that comes with knowing that you are covered in case of a total loss accident, vehicle theft or breakdown, and unexpected life event.

Don't go Unprotected - GET GAP!

You've just financed your dream car. Well, before you drive away, consider this:

• About 15 to 20 percent of collision claims in the U.S. result in the cars being totalled.

• Auto theft occurs every 33 seconds in the U.S. Statistics from the FBI indicate that 42.8 percent of stolen vehicles are unrecovered.

• It's normal for a vehicle's loan balance to be higher than its actual cash value, especially during the first few years of the loan.

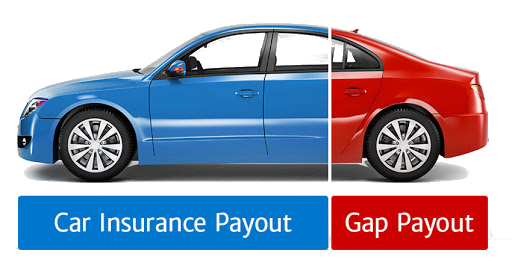

If your vehicle is totalled or stolen, your insurance settlement will be based on its actual cash value, not the outstanding loan balance. This may create a deficiency balance or a "gap".

Guaranteed Asset Protection (GAP) eliminates the potential for loss in the event your vehicle is totalled or stolen. In addition to the protection GAP offers, our program may cover your auto insurance deductible for up to $1,000.

Without GAP you are liable for the deficiency balance. This means you could end up paying for a vehicle that you can no longer drive, while forced to purchase a replacement vehicle. Drive your dream car knowing you are safe from falling into the "gap"!

Auto Deductible Reimbursement (ADR)

Also, by purchasing GAP you will receive a complimentary benefit called Auto Deductible Reimbursement (ADR). Features below:

• Pay up to $500 per loss when a claim is filed, paid limit of two (2) losses per year.

• Available 3-year term of coverage.

• Coverage is effective upon the date of enrollment (no waiting period).

• The product covers ANY vehicles the member owns AND insures.

For more information on the benefits and pricing, speak to a Credit Union Representative today.

Avoid Unexpected Auto Repair Costs ![]()

Before you purchase your next vehicle, whether new or used, be sure to check with the credit union for a quote on its Extended Warranty Protection program. There's nothing more frustrating than having your car's warranty run out the day before you have a major mechanical breakdown. And believe it or not, this really does happen.

Our program offers a complete package designed to protect you from expensive repair bills when mechanical failures occur – whether it's the transmission, suspension, air conditioning, or any one of the major systems that may need costly repairs or replacement.

There are many car dealers out there offering expensive extended warranties, but few cover you like our program. And the savings are rather substantial! Typically, the cost for one of our contracts will be 30-50% less than those offered at the dealerships. And our program provides some of the most extensive coverage available in the industry, as well as these great benefits:

- Towing Coverage Rental Car Coverage

- Trip Interruption 24-hour Roadside Assistance

And best of all, these plans are affordable and can easily be added to your auto loan. Contact a Credit Union Representative today to take advantage of this valuable program and drive home your new or used car with peace of mind.

Relax! You're covered ![]()

With our Auto Essentials insurance, you are covered for a wide range of vehicle protection services including:

- Key or Remote Replacement - Replacement of lost, stolen, or destroyed keys or remotes

- Dent & Ding Repair - Permanently removes door dings and minor dents without harming a vehicle's factory finish

- Tire & Wheel - Repair or replacement of punctured, cut, or flat tires and wheels due to road hazards or potholes

- Cosmetic Wheel Repair - Concierge service that repairs cosmetic damage to covered wheels including damage to chrome wheels or rims

- Roadside Assistance - The service includes basic mechanical repair, towing service, delivery of gasoline, flat tire assistance, battery assistance, and lockout service

Contact a Credit Union Representative today to learn more about this product and to request a quote.

Aftermarket tires/wheels are covered as long as the original invoice can be provided. If no invoice is available, tires/wheels will be replaced based on the original manufacturers' tires/wheels.

What is Depreciation Protection (DPW)? ![]()

Depreciation Protection kicks in if your vehicle is ever totaled or stolen and not recovered at any time over the life of the loan. It waives some or all of your loan balance in the event of the total loss of your vehicle. The waiver benefit is equal to the difference between your vehicle’s MSRP or retail value at the time of DPW purchase, less the amount of your loan balance at the time of total loss. DPW is ideal for those who put money down or have equity in the vehicle, desire protection from vehicle depreciation, and desire peace of mind knowing the money invested in a vehicle could be protected.

Benefits of protection:

- Benefit triggered by collision or comprehensive total loss, including theft

- Life of loan protection

- No mileage, make, or year restrictions

- Open enrollment

- 100% refundable for the first 60-days

- Accidental Death protection included, which provides for cancellation of up to $1,000 of your outstanding loan balance if the borrower passes away in an accident

Contact a Credit Union Representative today to learn more about this product and to request a quote.

Protect your family from tomorrow's emergency

Your life can change in a fraction of a second. Have you thought about what that could mean to your family? Because life is unpredictable, take steps now to protect your family. Don't leave them scrambling to pay monthly bills if the unthinkable happens. Credit insurance reduces or pays off the insured balance of your loan in the event of your death or disability. Credit Insurance can help relieve financial pressure for your loved ones. Monthly premiums are conveniently included with your monthly loan payment.

- How long can you afford to be without a paycheck?

- Are you prepared if you are disabled?

Less than 5% of disabling accidents and illnesses are work-related. The other 95% are not, meaning Workers' Compensation doesn't cover them.*

Talk to a Credit Union Representative today about whether Credit Insurance protection makes sense for you.

TruStage Auto Insurance Program

You trust your Credit Union to offer products and services to help you do more with what you have. That's why we've joined with a dedicated team of insurance professionals to bring you the TruStage Auto Insurance Program.

Working with carefully selected auto insurance partners, the TruStage Auto Insurance Program can provide discounted rates for Credit Union members, online services, and 24/7 claims service.

If you haven't compared auto insurance lately, it's a great time to take a look. Your credit union membership could result in some nice savings.

Get your free quote today or call 1-855-483-2149.

TruStage™ Auto Insurance program is offered by TruStage Insurance Agency, LLC and issued by leading insurance companies. Discounts are not available in all states and discounts vary by state. The insurance offered is not a deposit and is not federally insured. This coverage is not sold or guaranteed by your Credit Union.

AUTO SHOPPING TOOLS

Find The Right Vehicle For YOU!

We don’t want you to overpay for your vehicle. Through the auto shopping tools below, you have free access to research and pricing tools to assist you in your next car hunt.

We make it easy to shop for a new or pre-owned vehicle by providing valuable information such as:

- Research new and used vehicles

- Compare vehicle prices and values

- Check available styles, trims, and options

- Build your ideal car with the option to save it

All of these resources are here to help you make an informed choice that works best for you.

Your Smart & Simple Way to Real Savings!

Most people start their new car search by going online and then visiting a dealership to "look around". The problem is that the sales staff knows that if you don't buy during that first visit, it's very probable you won't return. This results in everything that consumers dread about car buying... especially the uncertainty and stress of unplanned decision-making.

When was the last time you absolutely knew you got a great deal? Probably never! That's why you have access to the professional car buying services of Auto Advisors, a No-Cost Member Benefit2, courtesy of your Credit Union!

With Auto Advisors, You'll:

- Earn a special Auto Advisors rate discount of 0.25% off your approved rate1

- Save time as our advisors search for the perfect car for you

- Eliminate dealer pricing games

- Get the most value for your trade

- An advisor can even accompany you to the dealership

- Delivery option to your home or office

Call an Auto Advisor today at 800-929-8971 or click here to start your next vehicle search.

Let Auto Advisors find you the perfect car for less!

1: APR =Annual Percentage Rate. Discount applied to your approved auto loan rate. Rates as low as 2.20% APR for 36 months. The rate cannot go below the floor rate of 2.20%APR. Rate includes a 0.25% discount for vehicles financed with a loan to value (LTV) of 80% or less. Advertised rates are subject to change without notice. The actual rate and guidelines may vary based on creditworthiness, collateral, and other factors. All loans are subject to approval. Baptist Health South Florida FCU membership is required. Other restrictions may apply. 2: Auto Advisors receives a transactional fee from the dealer not dependent on dealer profit.

Our Used Car Package - At Enterprise Car Sales, we take the stress out of used car pricing and provide you with the peace of mind that you're buying a quality certified used vehicle.

Used Car Pricing - You'll never haggle with a salesperson. The price you see is the price you pay. Our used car prices are always posted in plain view so you can avoid unpleasant negotiating.

Vehicle Certification - We only sell certified used vehicles. Every Enterprise used car has passed a rigorous 109-point inspection performed by an ASE-Certified technician.

Free CARFAX® Reports - A free CARFAX® Vehicle History Report ™ is available for all certified used cars and trucks we sell.

Trade-Ins Welcome - We'll give you Kelley Blue Book® Trade-in Value on your vehicle when you purchase a certified used vehicle from us.

Worry-Free Ownership - Our job doesn't end when you pull off the lot. For your continued driving pleasure, we offer a unique combination of benefits to keep you happy down the road.

Financing - Baptist Health South Florida FCU will work with you to provide the best financing available.

The auto loan calculator provided on this page is for illustrative purposes only. The results are estimates and may not reflect actual loan terms, rates, or payments. Rates and prices are subject to change and may vary based on individual creditworthiness and other factors. For precise information regarding your loan options, please contact us directly.